The Fed Rate Cut

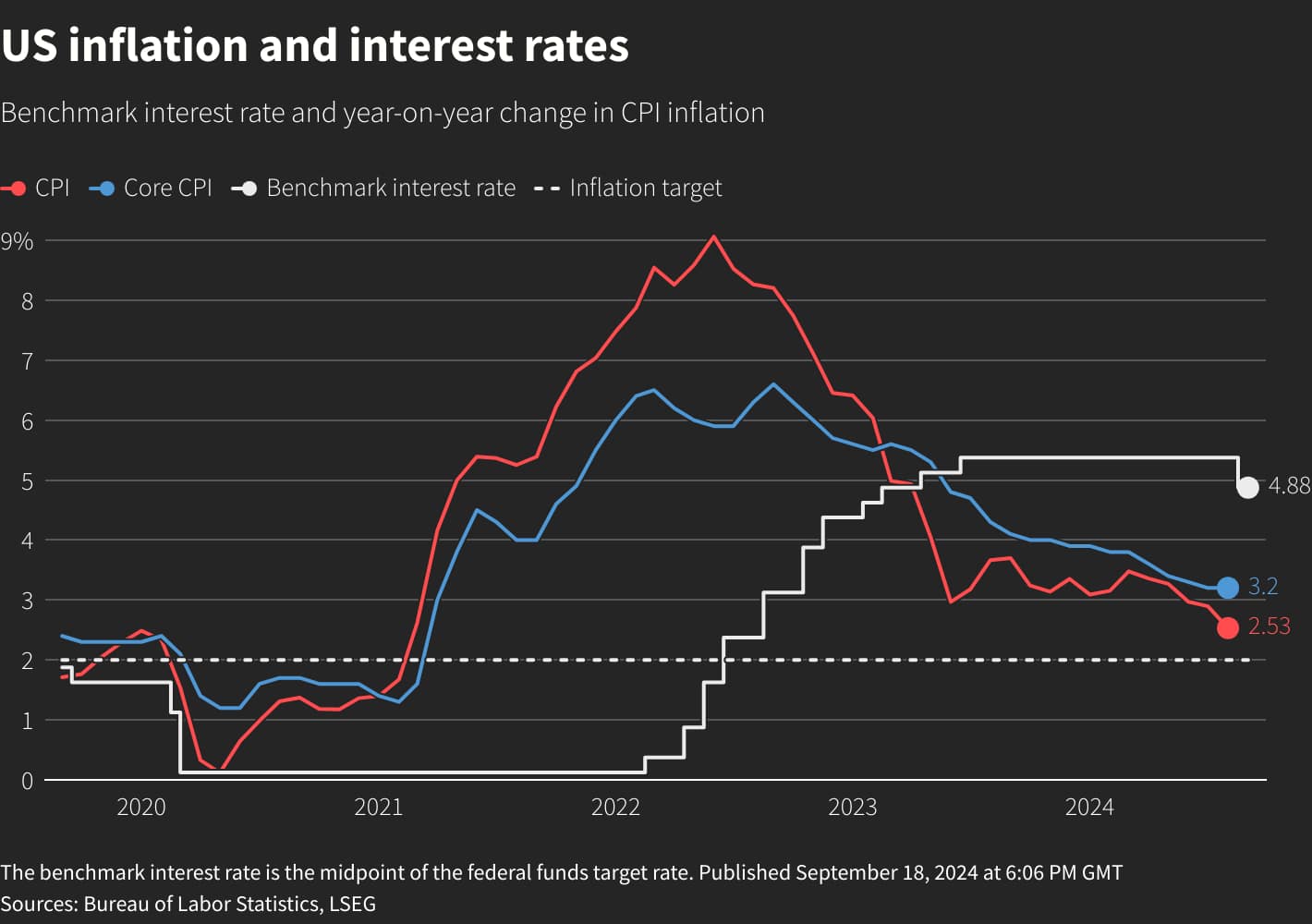

It’s September 2024 and the Federal Reserve has finally lowered its rate by .5% – a little more than we dared to hope for, with further rate cuts possible before the end of the year. This is great news because it suggets that inflation is finally trending downward and consumer confidence is gaining. However…

It doesn’t necessarily follow that mortgage rates immediately drop. The “Fed rate” is not tied directly to mortgage rates; instead it’s the fee U.S. banks pay each other to borrow or loan money overnight. The reduction does trickle down to products like credit cards, student loans and, yes, mortgages eventually we hope– but it may take a second. The good news is that homes are about to get more affordable.

New, Higher Conforming Loan Limits

You may have heard about ‘conforming loan’ limits rising. The Federal Housing Finance Agency (FHFA) regulates Fannie Mae & Freddie Mac and set the limits, which are essentially a cap on the amount of a mortgage they are prepared to guarantee. The FHFA typically raises these limits every fall, according to home prices. As home prices increase or decrease, loan limits respond accordingly.

Higher limits mean you can get a larger conventional loan while still benefiting from more flexible qualifying criteria and lower down payment options than with, say, a jumbo loan, which can be tougher to qualify for because they’re not backed by Fannie or Freddie.

However, jumbo loans etc. can still be great for the right clients. Their rates can be better than Fannie and Freddie because jumbo loans aren’t subject to loan level price adjustments (LLPAs).

On the downside, with all the pent up demand and buyers rushing back to the marketplace together, well, home prices are likely to respond accordingly. Upward. Remember the days of multiple offers on Day 1 with each higher than the last? Yeah me too. Seems like you just can’t win – but either way, paying off your own home sure beats paying off your landlord’s home.